January 2015: As we start another year, YouGov has just released a new survey regarding Social Network usage among adults in the US. And, it seems that the majority are members of social networks: overall only 15% stated they are not a member of any social networks. This number is higher for men (18%) than it is for women (12%). Among the larger platform,s only LinkedIn and Google+ have more male than female members.

As expected, Facebook is still in the lead, with three-quarters of all survey participants (80% of women, 70% of men) reporting being members. From the other networks, Twitter has (31%), Google+ has (29%) and LinkedIn has (28%). While men and women reported roughly equal use of Twitter, men were slightly ahead in Google+ usage (31% vs. 28%), with the gap larger on LinkedIn (30% vs. 25%).

Bringing up the rear is Pinterest with 18%. Interestingly, there is a large gap between men and women using Pinterest (28% among women; 9% among men). This is followed by the fast-growing Instagram (13%), although its audience leans more heavily towards teens, whom were excluded from the survey.

This data originates from a survey questioning how users react to certain type of post (such as racist, political, and sexist ones). The survey was fielded online from December 19-22, 2014 among 2,341 adults (18+), with the figures weighted to be representative of all US adults.

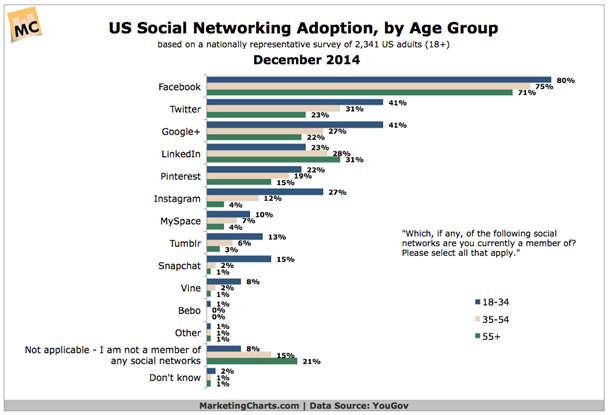

The YouGov survey results indicate the following usage among age groups:

- Twitter usage is highest among the 18-34 bracket (41%), with the 35-54 (31%) and 55+ (23%) brackets following behind;

- That disparity is even greater for Instagram, with 27% stated penetration among 18-34-year-olds, versus 12% among the 35-54 group and 4% in the 55+ bracket; and

- The +55 group (31%) is the largest user group on LinkedIn, compared to 28% of 35-54-year-olds and 23% of 18-34-year-olds.

Finally, when looking at race and ethnicity (in the US), the results reveal that:

- Twitter continues to appeal to Black Americans (42%) more than Whites (29%) and Hispanics (26%);

- LinkedIn is less popular among Hispanics (18%) than among Whites (28%) and Black Americans (28%);

- Instagram proves more attractive to Black Americans (19%) and Hispanics (15%) than to Whites (11%); and

- Google+ similarly sees higher reported penetration among Black Americans (35%) and Hispanics (34%) than among Whites (27%).